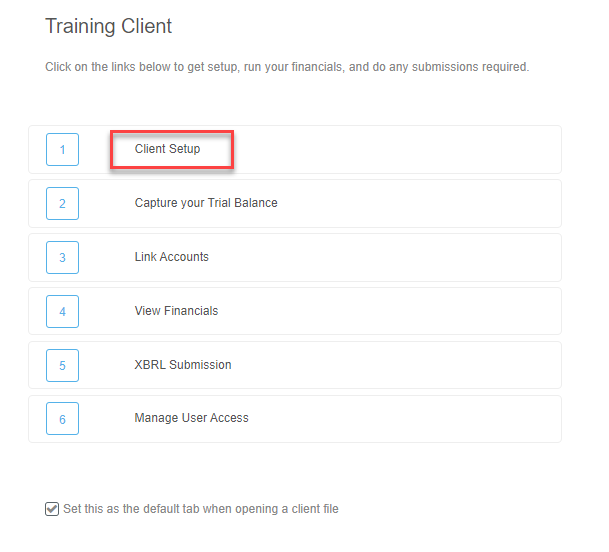

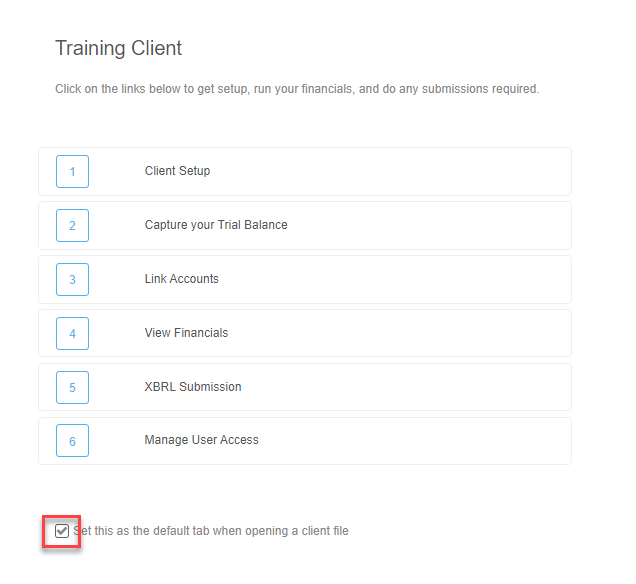

Click on Client Setup on the Startup screen:

OR

Go to Client Setup>Client Setup and enter in all applicable information as follows. Most of the items are self explanatory, but we have elaborated where we feel necessary. Please contact Support if anything is unclear.

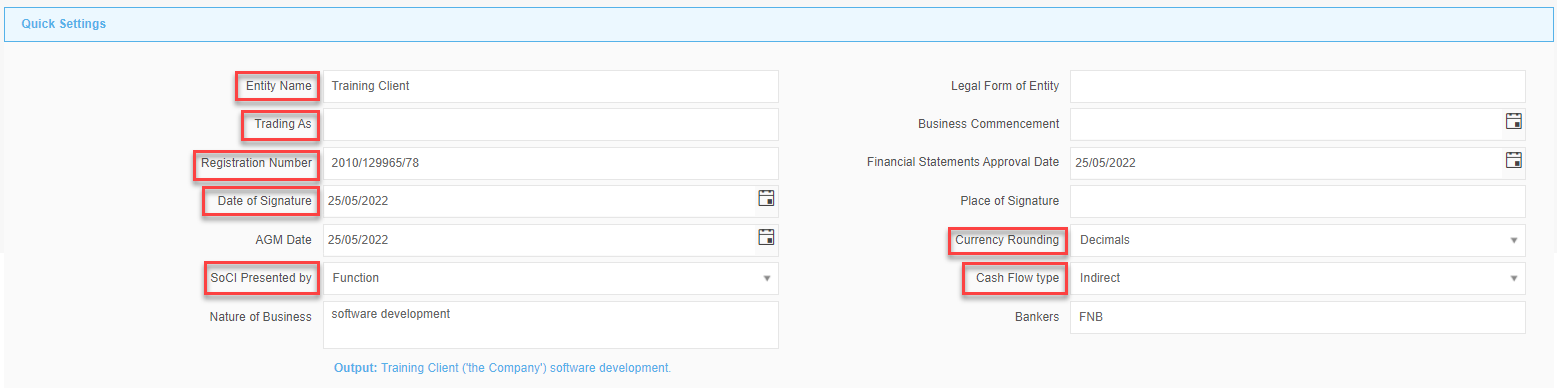

Quick settings

These are the most commonly used settings:

Entity name – This is the registered Company Name (auto populates when you create the file), and will display on all pages of the Financial Statements.

Trading As – If the company has a Trading As name you can enter it here and it will display on the Cover sheet.

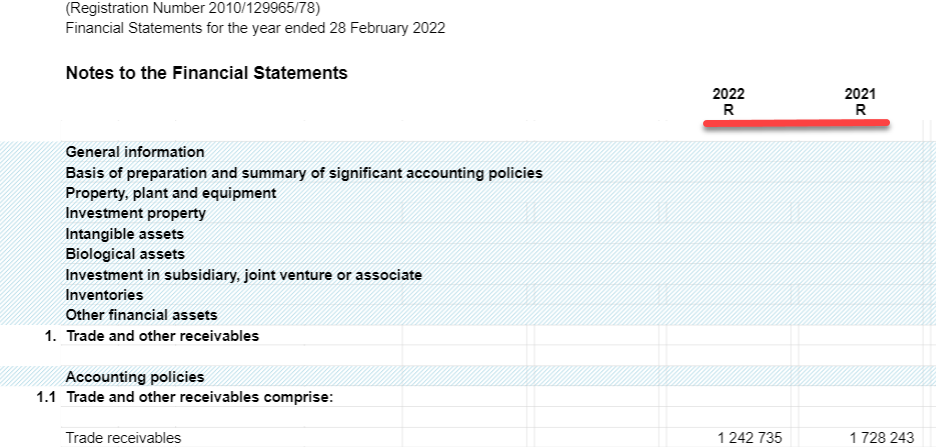

Registration Number – The company's registration number, which will appear on every sheet of the financial statements.

Date of Signature – The date of signature is the date that the financials are signed by the directors and the accountant/auditor.

SoCI Presented by - Select "Function" or "Nature"

Currency rounding - The default is set to "Decimals" (the cents will be hidden). You have the option to round to thousands, million etc. The values are always the same, its just the display format which is set here.

Cash Flow type - Select between "Direct" (Operating, Investing, Financing Activities) or "Indirect".

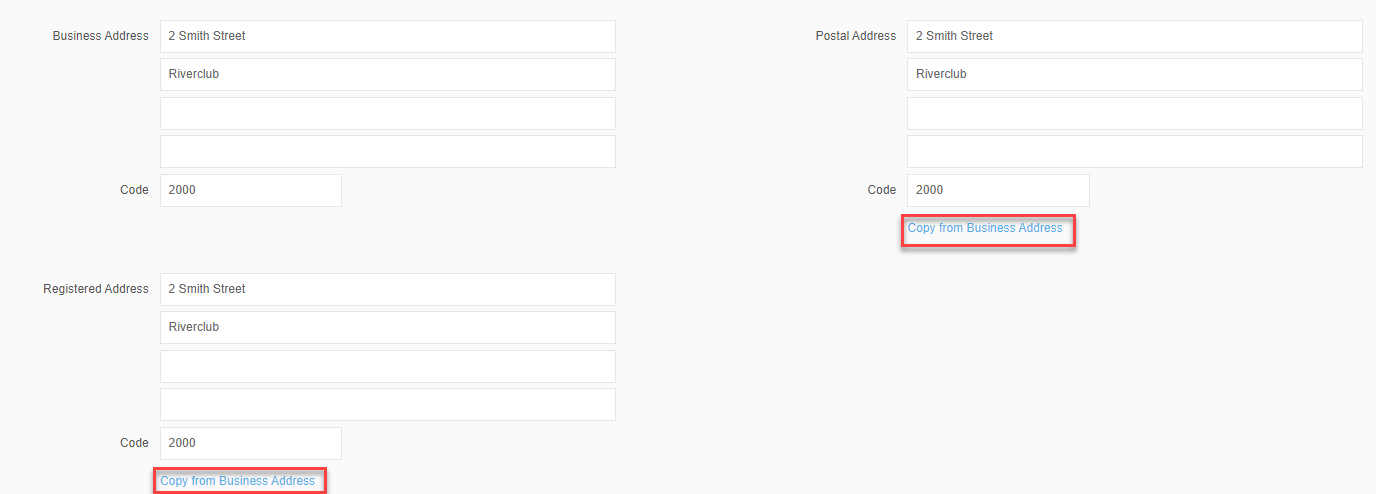

Addresses - Postal and Registered can be copied from Business Address:

Delete

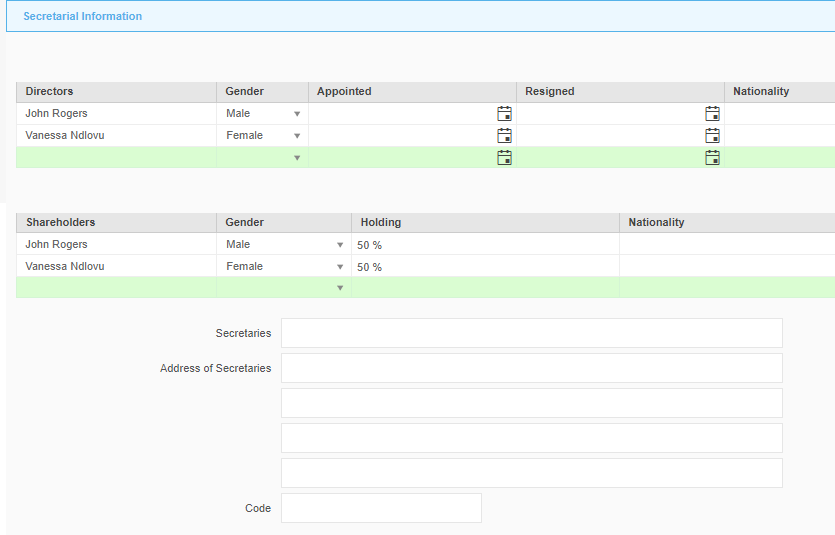

Secretarial Information

Directors – The details of the directors of the company need to be filled in here. As you fill in the name a new line is generated for the next director.

Shareholders - The details of the shareholders of the company need to be filled in here. As you fill in the name a new line is generated for the next shareholder.

Secretaries – The client's secretaries details display on the Management Information and the Directors’ Report sheets.

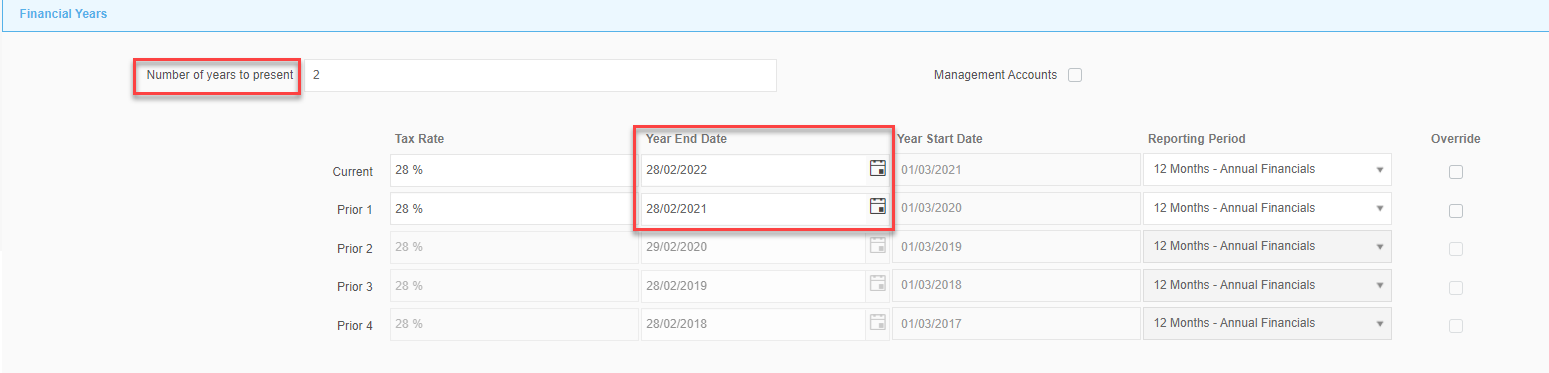

Financial Years

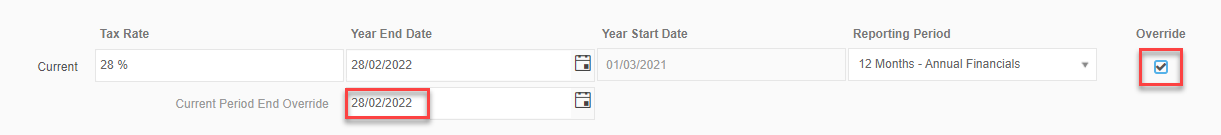

Number of Years to Present will default to 2 - Current & Prior Year. If it is the entity's first year of trading, you can amend to "1" so that the prior year columns and notes are automatically hidden. You are able to display up to 5 years should you wish.Amend the Year End Dates if necessary. An important note: Do not amend to accommodate Management Financials dates. These will always be the actual year end dates of the entity. For management reporting, you can amend the Reporting Period to display the correct period; Financial Period Override will display the actual date of the report (DD-MM-YYYY).

DeleteAdditional Disclosures

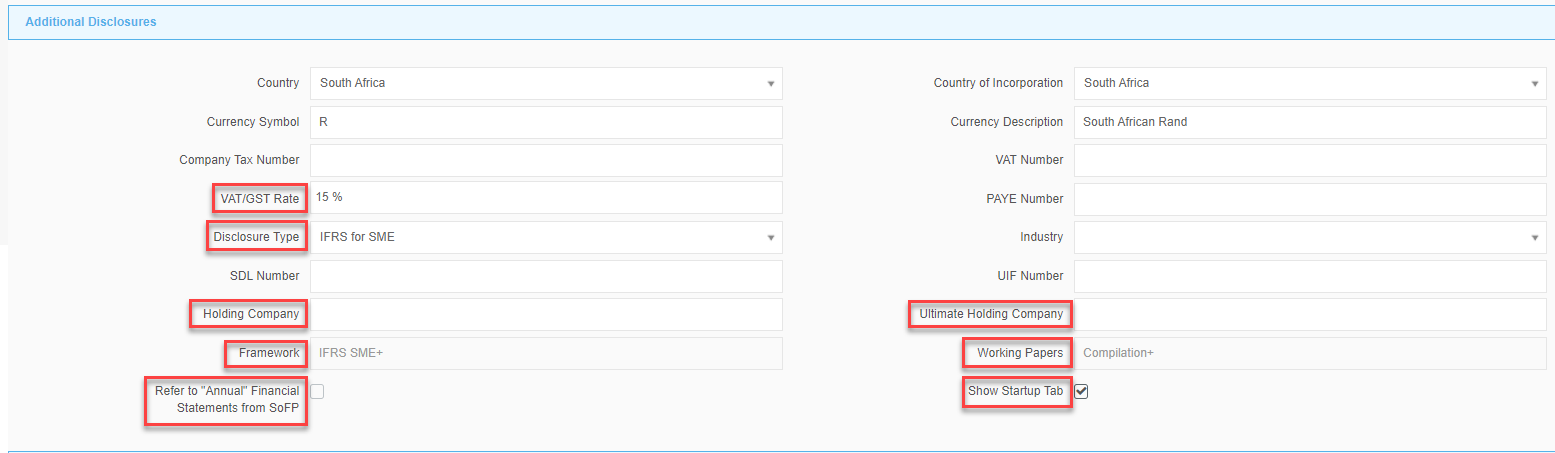

VAT/GST rate - Will default based on the country selected when you create the file. Amend as necessary.

Disclosure type - Will default to IFRS/IFRS-SME based on the template selection. Amend to Basis of Accounting where necessary.

Holding Company – The client's Holding Company information is used in the XBRL submission to CIPC (If applicable).

Ultimate Holding Company – The client's Ultimate Holding Company information is used in the XBRL submission to CIPC (If applicable).

Framework - Based on the template selected when creating the file.

Working Papers - Also selected at the start. Includes guidance and supporting documentation for the specific type of engagement undertake.

Refer to "Annual"... - Tick this option if you would like the header to state: Annual Financial Statements..." from the Statement of Financial Position onwards.

Show Startup Tab - This will invoke the Startup tab with the wizard, guiding you through the process. You can also switch it off where indicated:

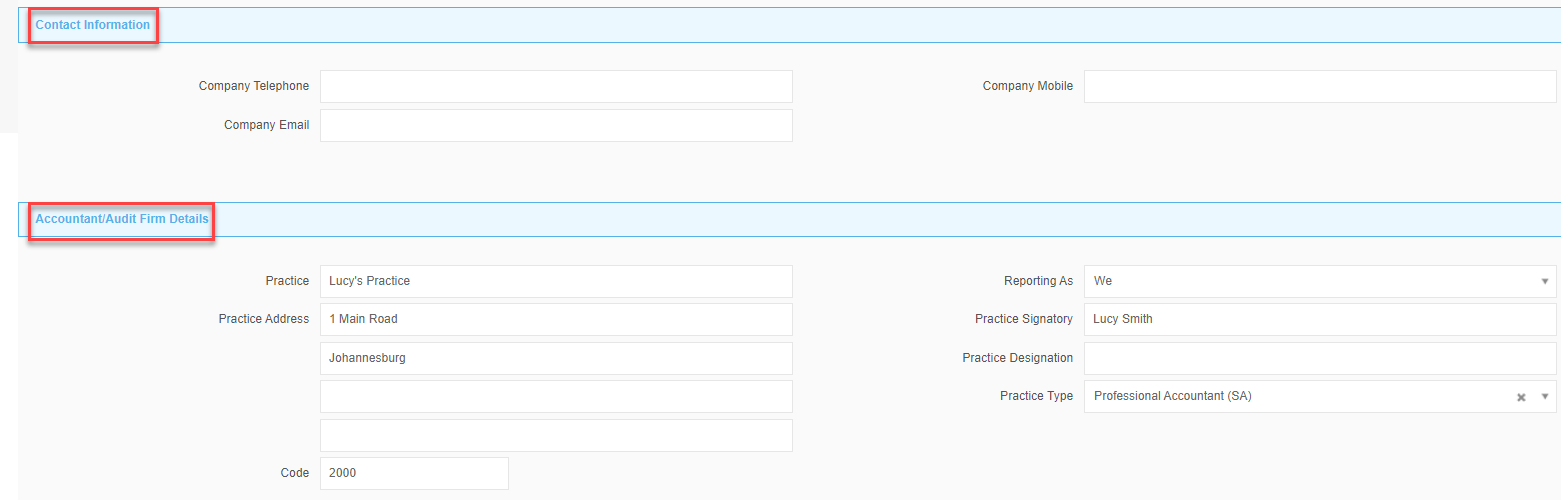

Contact Information

This is split between the Client and Accountant/Auditor (external engagement, if applicable):

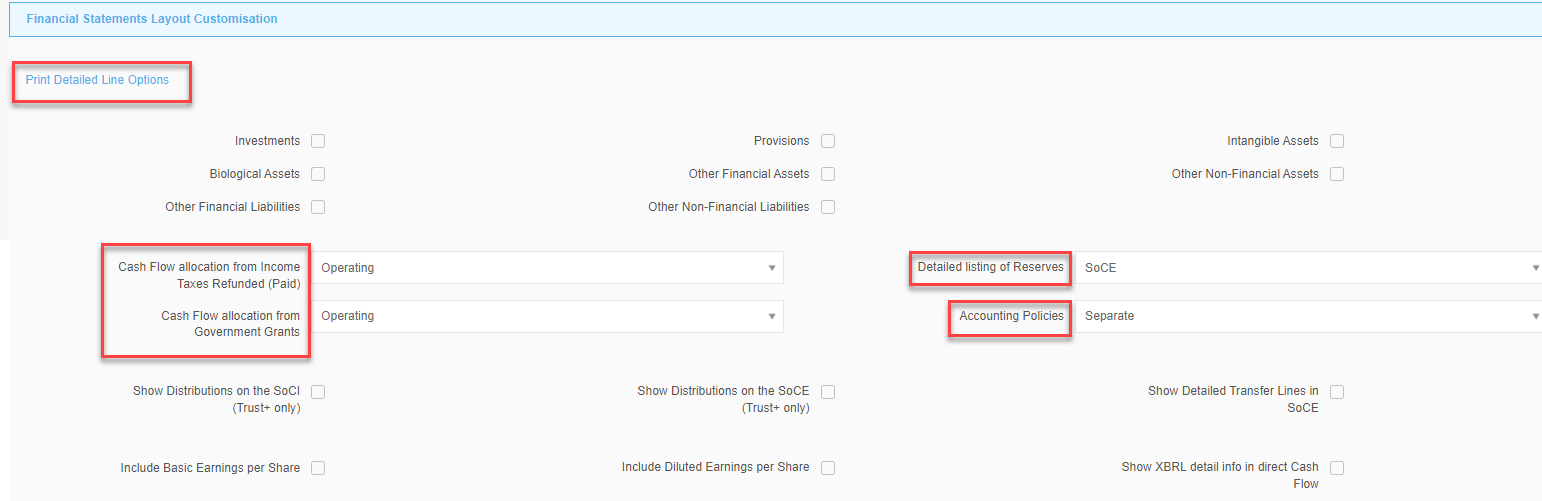

Layout Customisation

Print Detail Line Options - Allows for a more detailed

Cash flow allocation for Income Tax and Government grants. Select the applicable portion of the Cash flow.

Detailed listing of Reserves - you have the option to display in the SoCE or in the Note.

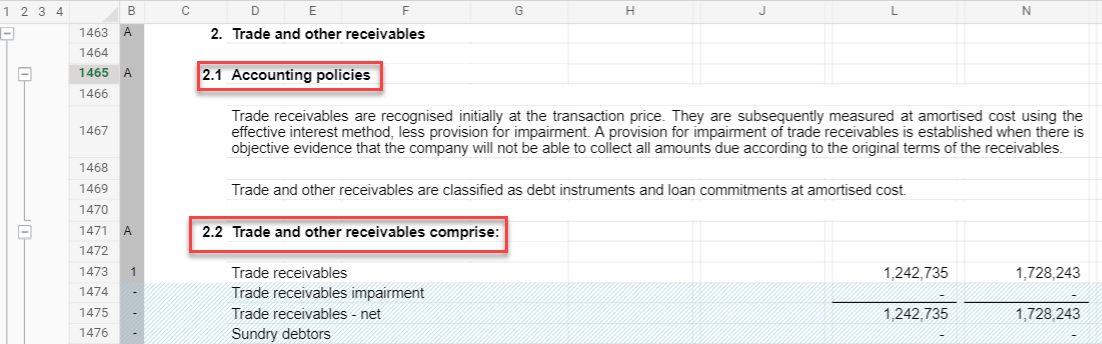

Accounting Policies - You can elect to show your Accounting Policies and Notes separately, or combined, for eg:

Note: Some people are surprised by this option. Rest assured, it is 100% compliant, and certainly makes for an easier read. Why not give it a try? (You can always switch back)

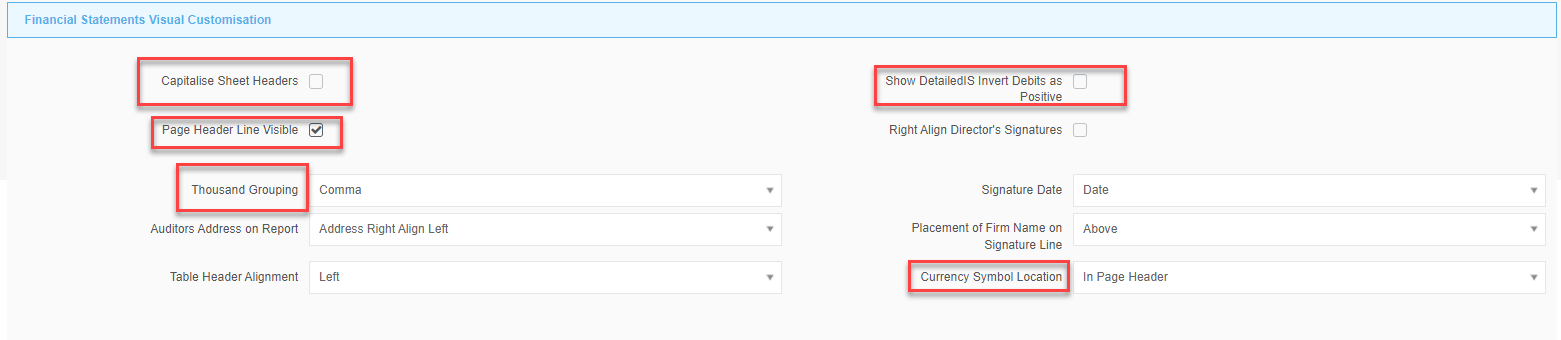

Visual Customisation

Capitalise Sheet Headers - For eg:

vs

vs

Show Detailed IS Invert Debits as positive - Show expenses as positive (+) values rather than the default negative (-)

Page Header Line Visible - For eg:

vs

Thousand Grouping - Optional to group by comma or space:

vs

Currency Symbol Location - Optional for table or page header:

Delete

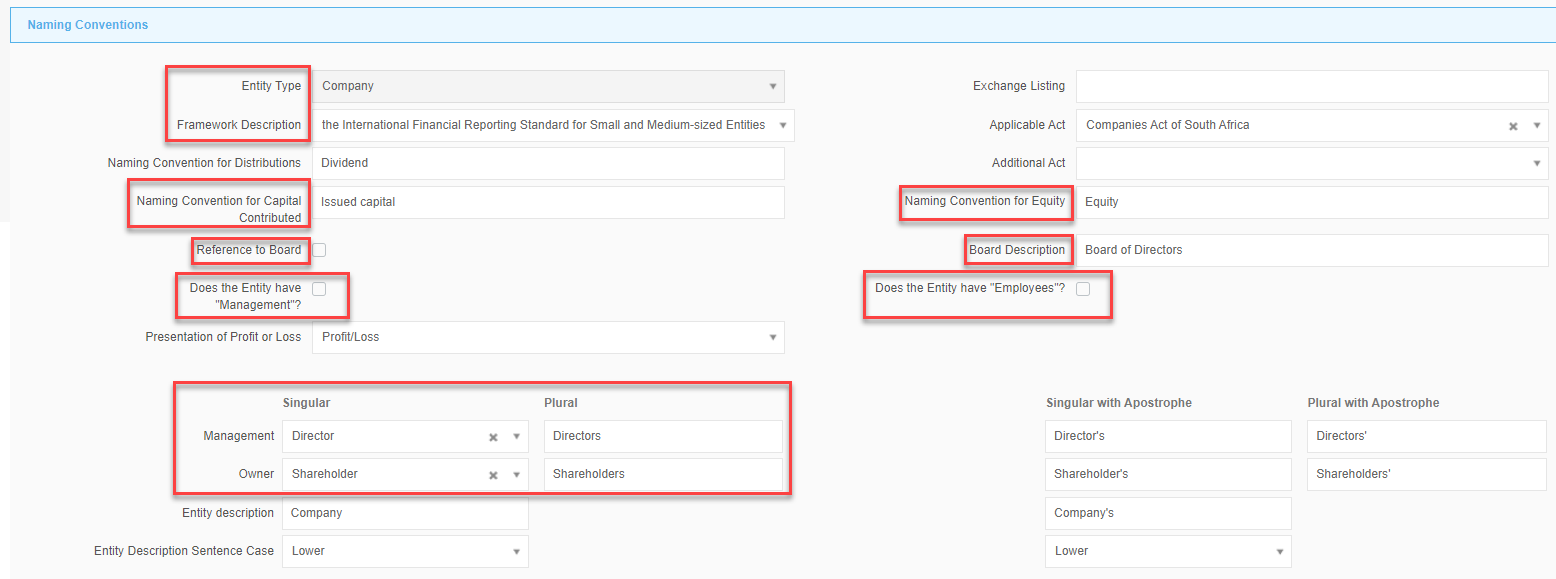

Naming conventions

Entity Type/Framework Description – This is set automatically depending on the Framework that you selected when creating your Client file.

Capital Contributed/Equity - Amend if necessary, for eg: if you want to refer to Share Capital on your Statement of Financial Position.

Reference to Board/Board Description - Amend as necessary - for eg: "Board of Governors" for a school.

Management/Employees - Tick as applicable - Will affect the wording of specific sheets in the template.

Management/Ownership - Set by default based on template selected at the beginning for eg: The Trust template will refer to Trustees and Beneficiaries, etc.