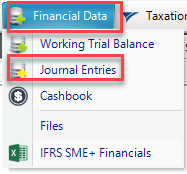

To process journals go to Financial Data>Journal Entries:

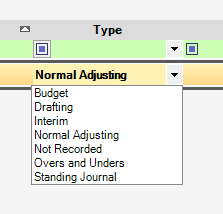

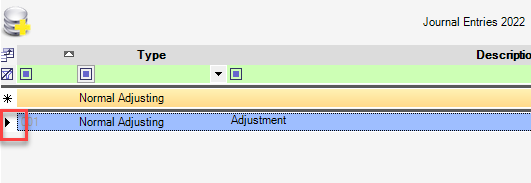

In the journal screen, select the type of journal to be processed:

Budget: You are able to make adjustments to your Budget figures.

Drafting: This is used when you need to do journals that are applicable to your audit trial balance only. These adjustments are not sent back to the client's trial balance. An example of this might be splitting depreciation into separate expense accounts.

Interim: If you are drafting Interim financials, you can make adjustments to these values specifically.

Normal adjusting: This is used for any normal journals applicable to the client. You would use it for adjustments to accounts that you want to push back to the clients processing trial balance after you finalise the Financials.

Not recorded: This is used for a journal that has not been finalised or approved yet. You can also switch between not recorded and a normal adjusting journal to see the effect that your journal would have on the financials.

Overs and unders: This is used for adjustment amounts which cover non-material transactions that are overstated or understated. These do not affect your working trial balance and can be discussed with management as to whether they should be passed or not.

Standing journal: This journal will be carried forward into the client's following year. If you create a standing journal in the 2021 year you can roll forward into 2022 and that journal will be copied and affect both your 2021 and 2022 trial balances. Standing journals are often used for consolidation elimination journals.

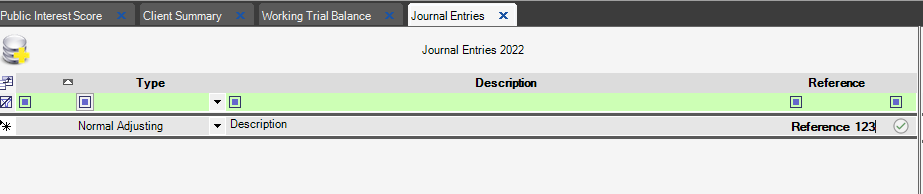

Once you have selected the Adjustment Type enter a Description and Reference if applicable.

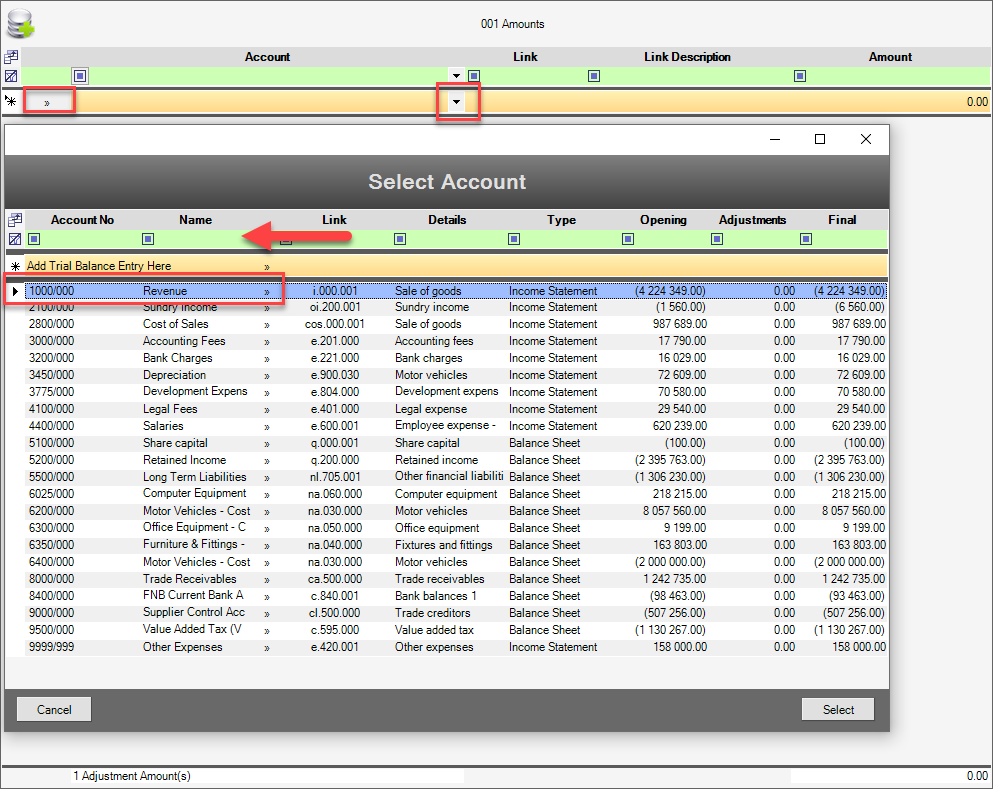

Hitting the <ENTER> key will take you to the right side of the screen where you will process the adjustment. Select the account to be affected (You can search for the account via the green search bar):

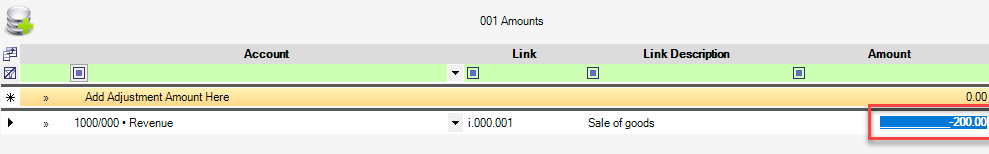

Enter the value: Negative (-) for Credit, Positive (+) for Debit

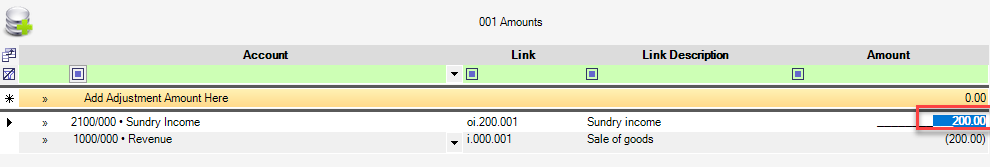

Hit <ENTER>, then select the contra account above and the value (balancing entry): Obviously if you splitting between various accounts just add additional entries:

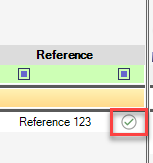

If your journal is in balance, there will be a green tick as indicated (and a zero balance at the bottom right of your screen).

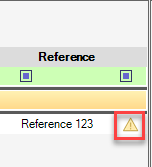

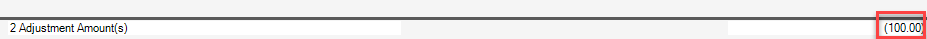

If not, there will be a warning icon instead, and a value on the bottom right:

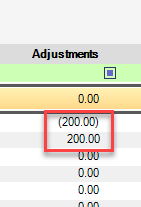

The adjustment values will be show on your working trial balance in the Adjustments column:

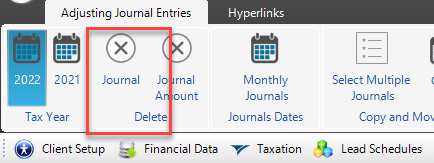

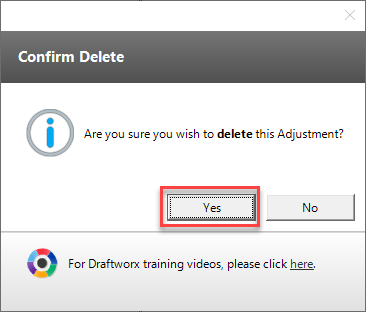

To delete a journal, click on the small black triangle on the left and hit the <DELETE> key or Delete Journal at the top, and then Yes

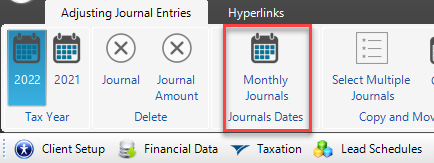

Monthly Journals: To process Monthly Journals, simply select this option at the top of your screen:

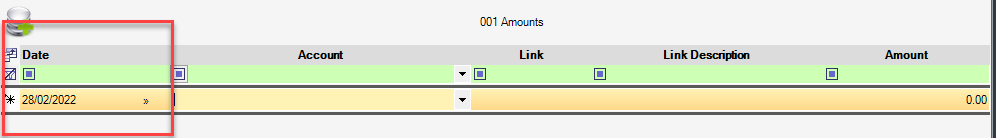

You will be prompted to enter the specific adjustment date:

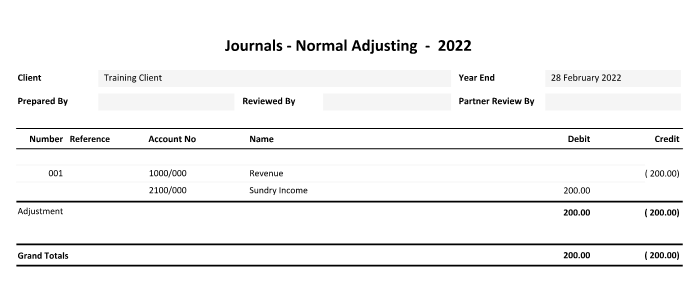

Journal report: To pull a journal report, go to Reports>Journals - <TYPE>, then select the Year