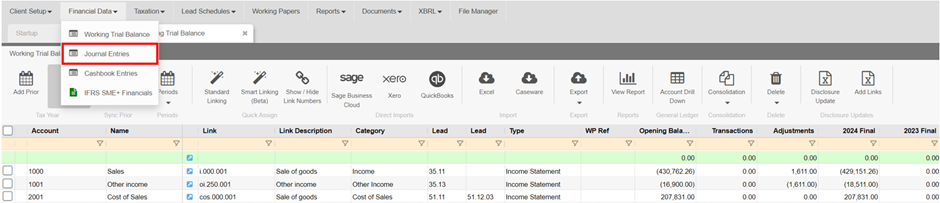

To process a journal, go to Financial Data...Journal Entries:

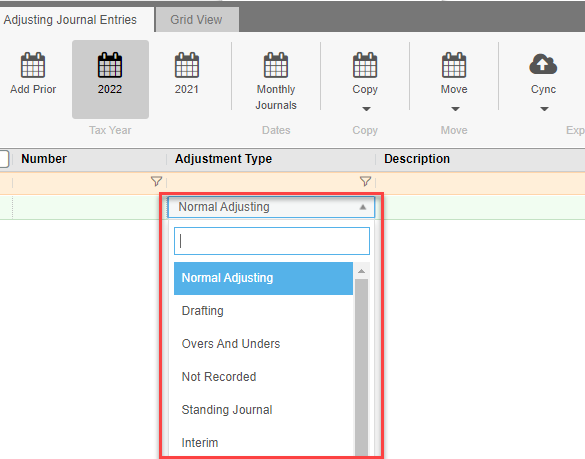

Select the applicable journal type:

Normal adjusting: This is used for any normal journals applicable to the client. You would use it for adjustments to accounts that you want to push back to the clients processing trial balance after you finalise the Financials.

Drafting: This is used when you need to do journals that are applicable to your audit trial balance only. These adjustments are not sent back to the client processing trial balance. An example of this might be splitting depreciation into separate expense accounts.

Overs and unders: This is used for adjustment amounts which cover non-material transactions that are overstated or understated. These do not affect your working trial balance and can be discussed with management as to whether they should be passed or not.

Not recorded: This is used for a journal that has not been finalised or approved yet. You can also switch between not recorded and normal journal to see the effect that your journal would have on the financials.

Standing journal: This journal will be carried forward into the clients next year. If you create a standing journal in the 2019 year you can roll forward into 2020 and that journal will be copied and effect both your 2019 and 2020 trial balances. Standing journals are often used for consolidation elimination journals.

Interim: If you are drafting Interim financials, you can make adjustments to these values specifically.

Budget: You are able to make adjustments to your Budget figures.

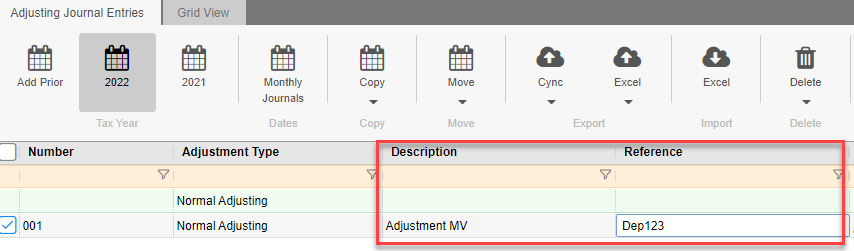

Once you have selected the Adjustment Type you can move on to your journal Description and Reference. Here you can type in the reason for your journal and a reference number if applicable.

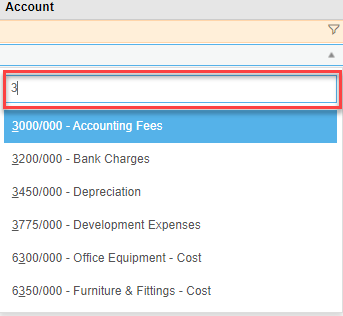

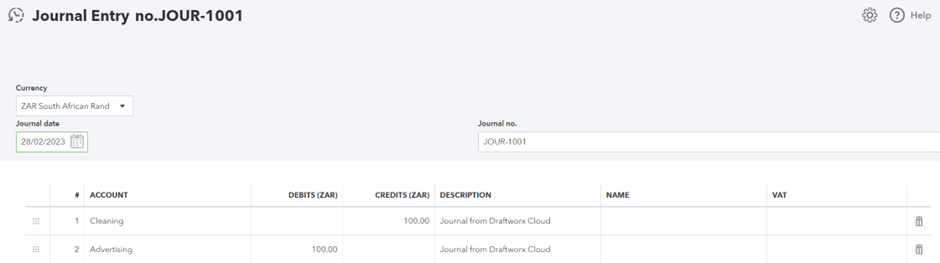

You will notice that the screen is split. On the right-hand side is where you will select the relevant adjustment accounts:

You can search for an account either by account number, or by account name.

OR

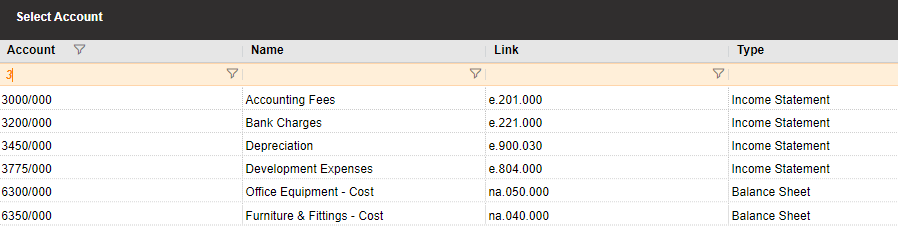

Click on the blue arrow, which will expand the full list of accounts from where you can search/select accordingly:

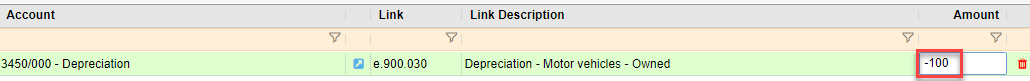

Once you have selected the account, type in the adjustment amount (-) for Credit, Positive (+) for Debit:

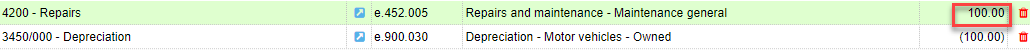

Then select the contra account and enter the amount:

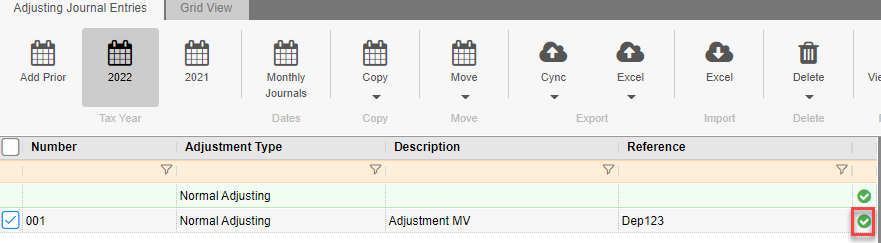

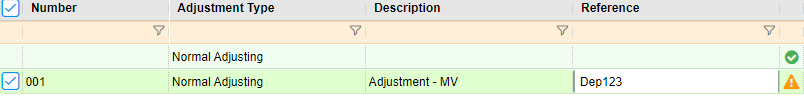

The green tick on the left side of the screen will show you that the journal is in balance:

If it is out of balance, you will see a yellow exclamation mark:

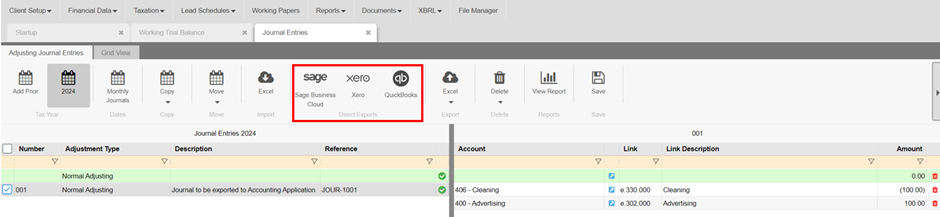

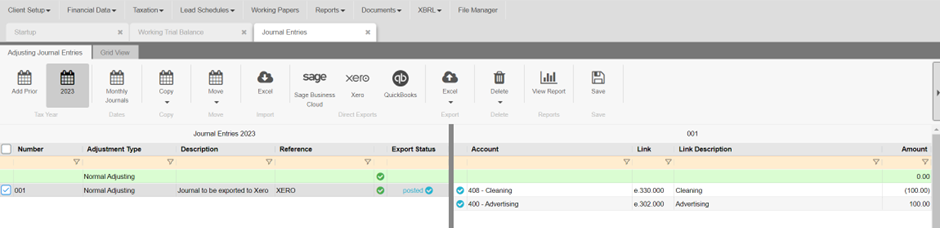

To post back into your accounting application:

If you imported your trial balance from Sage Business Cloud, Xero or QuickBooks Online using Direct Imports, you can also post these journals from Draftworx.

Ensure that the journal is selected on the left, then choose your Accounting Application on the Direct Exports section on the Toolbar.

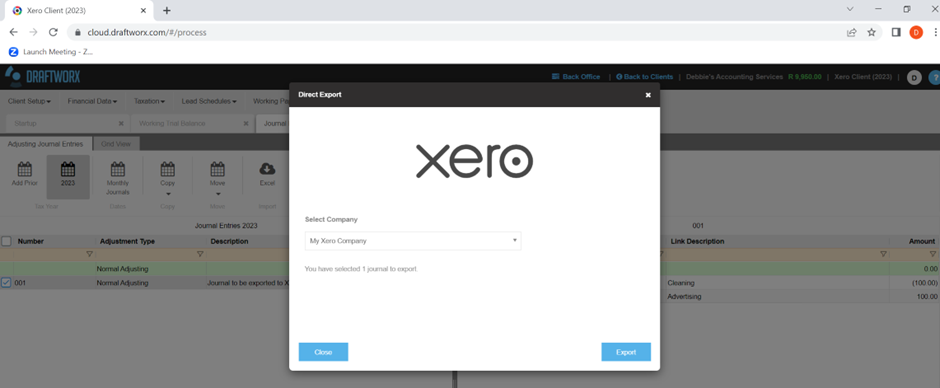

The Direct Exports confirmation screen will appear, displaying your company name and the number of journals to export. If the journal batch is out of balance or if there is any other reason for the export to fail, this will be displayed here. Click on Export.

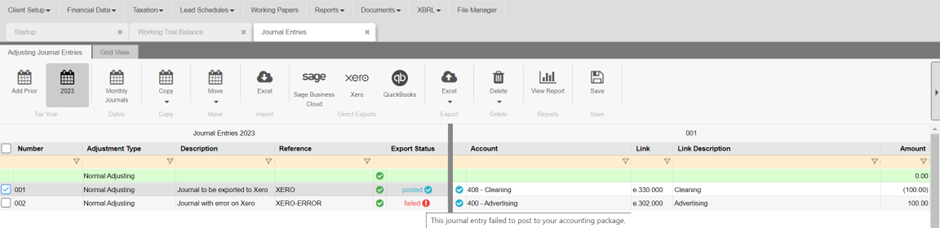

Once the journals are exported, they will appear in your accounting application and the Export Status will update and show as posted.

If a journal entry posted to any of the accounting applications fails, a failed Export Status will display with a reason for the failure. If there is a specific error on an account in that journal, an additional warning will appear on that account.

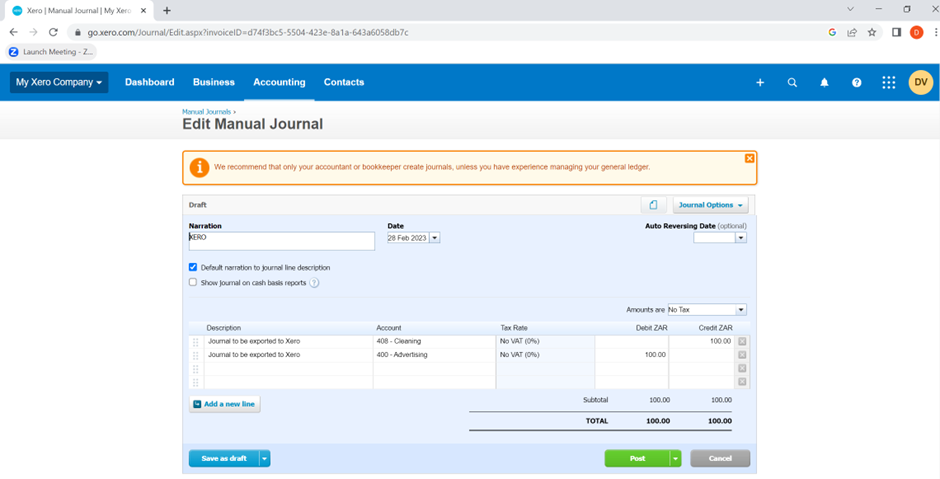

Posting journals - Xero

Your journals will appear in the Draft tab under Manual Journals. These journals should be reviewed and then posted in Xero.

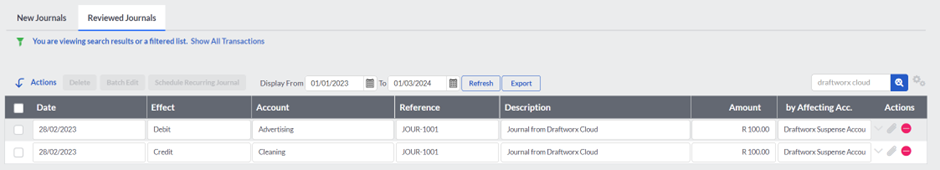

Posting journals - Sage Business Cloud

Your journals will appear in the Process Journal Entries screen on the Reviewed Journals tab.

Posting journals - Quickbooks Online

Your journals will be posted and you can view them by doing a transaction search or by running one of the transaction reports.

For a quick video on journals please click below: